The IRS Says Some People May Need to Return Their $1,400 Stimulus Check

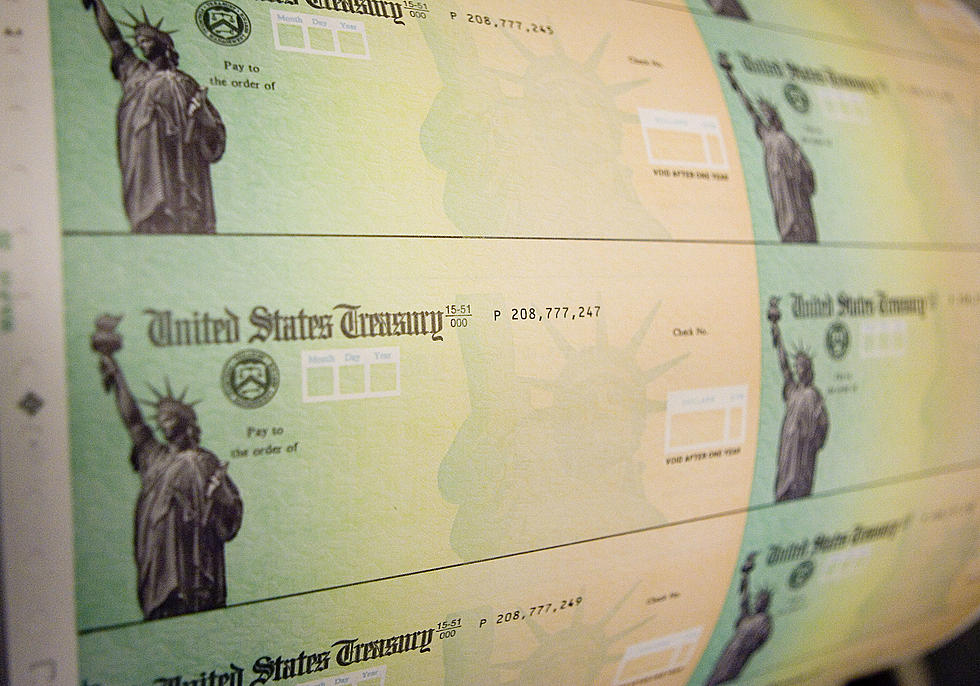

The United States has handed out a third stimulus package and millions of Americans received $1,400 in their bank account.

However, some may need to return the $1,400 to the IRS. According to Kiplinger, some who got a stimulus check should not have received it and the IRS wants you to send the money back.

So, who needs to return the money to the U.S. Government? Well, let's break it down here.

For one, those who got the $1,400 payment but are considered "nonresident aliens" should not have received the payment. That individual does not possess a green card and has not been in the country long enough to receive payment.

Secondly, if any person has died and got a $1,400 check, the money needs to be returned to the IRS. No, the family cannot keep the stimulus check.

According to Kiplinger, anyone who died before January 1, 2021, is not eligible for a third stimulus check. You must also include a letter explaining the situation.

Lastly, if you don't need the money or you don't want the money, you can send it back to the Federal Govenment. So, if you were critical of the payouts during the pandemic and you don't want the money, just send it back.

The IRS also encourages those who got the $1,400 but don't need it to donate their stimulus check to their favorite nonprofit or charity organization in their community.

Also, if you received payment via a debit card you can return the funds to Money Network Cardholder Services, 2900 Westside Parkway, Alpharetta, GA 30004.

For Louisiana residents you can send your stimulus check back to the following address:

Austin Internal Revenue Service

3651 S Interregional Hwy 35

Austin, TX 78741

7 Things You Can Buy for a Billion Dollars

More From KDHL Radio

![ER Nurse Delivers Emotional Statement About COVID Patients She’s Treating [VIDEO]](http://townsquare.media/site/34/files/2021/08/attachment-Screen-Shot-2021-08-05-at-8.17.57-AM.jpg?w=980&q=75)